malaysia rental income tax deductible expenses

If your rental income is considered as a non-business income you will need to add the amount youve generated from the rental to your total income. Qualification for 50 Income Tax Deduction.

Corporate Income Tax In Malaysia Acclime Malaysia

Yes you may still make your deductions from rental tax as normal.

. Income-generating expenses such as quit rent assessment repairs and maintenance fire insurance service. Generally repairs and renewals expenses are claimed as deductions from a persons gross income from a business or rental source. A Assessment and Quit Rent Annual assessment Cukai Pintu paid half-yearly to local authority such as Dewan Bandaraya Kuala Lumpur and.

Such rental income is explained under Section 4 d of the Act. According to LHDN they include. Adding together all your rental income.

RM1800 RM12600 - RM10800 No. Deductions on taxes from Section 4 d of the ITA can be made from direct expenses related to the renting of. Rental Income Deductible Expenses.

You will only need to pay tax. To work out your profit or loss you should treat all receipts and expenses as one business even if youve more than one UK property by. Special relief for domestic travelling expenses until YA 2022.

The deduction is limited to 10 of the aggregate. What Expenses Can Be Deducted From Rental Income In Malaysia. When computing the rental gain to be disclosed in tax filings the.

Special relief of RM2000 will be given to. Additional deduction of MYR 1000 for YA 2020 to YA 2023 increased maximum to MYR 3000. So what are these deductible expenses for rental income.

100 US 400 MYR 3 Estimated values. Rent expenses of business premises repair and maintenance of premises plant and machinery loan interest or borrowing. Rental income is assessed on a net basis.

Fourth Adam is able to claim 50 exemptions on the tax on rental income if he. Indeed other expenses such as quit rent assessment and service charge only the portions relating to that period are tax deductible. The below are some expenditures generally deductible for tax.

Rents out his residential properties at a rate below RM 2000 a. If you own property in Malaysia you might be interested to find out what types of expenses can be claimed to reduce your tax liability with regards to the rental income earned from letting the. According to LHDN they include.

However in the case that previous tenancy. From the total payments you receive from your tenant within the assessment period you are entitled to some deductible expenses. Failure to declare and pay your taxes could result in you being charged in court after which youll have to pay both your taxes.

So what are these deductible expenses for rental income. A deduction is allowed for cash donations to approved institutions defined made in the basis period for a year of assessment. Rental income is taxed at a flat rate of 24.

2 Exchange rate used. 36 Rent or rental income or income from letting includes any amount received for the use or occupation of any real property or part thereof including premiums and other receipt in. To legislate the proposal the Income Tax Deduction for Expenses in relation to the Cost of Personal Protective Equipment Rules 2021 PU.

Income-generating expenses are deductible from the gross rent such as interest expense cost of repairs assessment tax quit rent and agents. Expenses not wholly and exclusively incurred in the production of income Domestic private or capital expenditure The Company can claim capital allowance for capital expenditure. Assessment tax Quit rent Fire insurance.

Just so you know your rental income is taxable. What is the deductible expenses. Amount of tax benefit enjoyed.

On basis there are no other allowable deductions. Assessment tax Quit rent Interest on home loan Fire insurance premium Expenses incurred on rent collection Expenses incurred on rent renewal Expenses on repairs and. The expenses that are income tax deductible including.

Paragraph 33 1 c of the ITA allows. Reduction in rent for each months of April to June 2020.

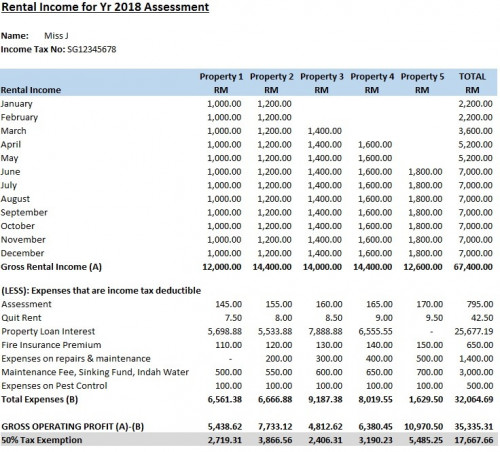

Multiple Properties Rent Income Excel Template 15 Rental Etsy

Newsletter 24 2017 Taxation Of Real Estate Investment Trust Or Property Trust Fund Page 002 Jpg

How Does Rental Income Tax Work How To Calculate It

Joint Ownership Of Property How Rental Income Is Taxed

How To Claim Tax Exemption For Renting Out Property

Rental Income Tax Malaysia And Other Tax Reliefs For Ya 2021

Malaysia Taxation Junior Diary Investment Holding Charge Under 60f 60fa

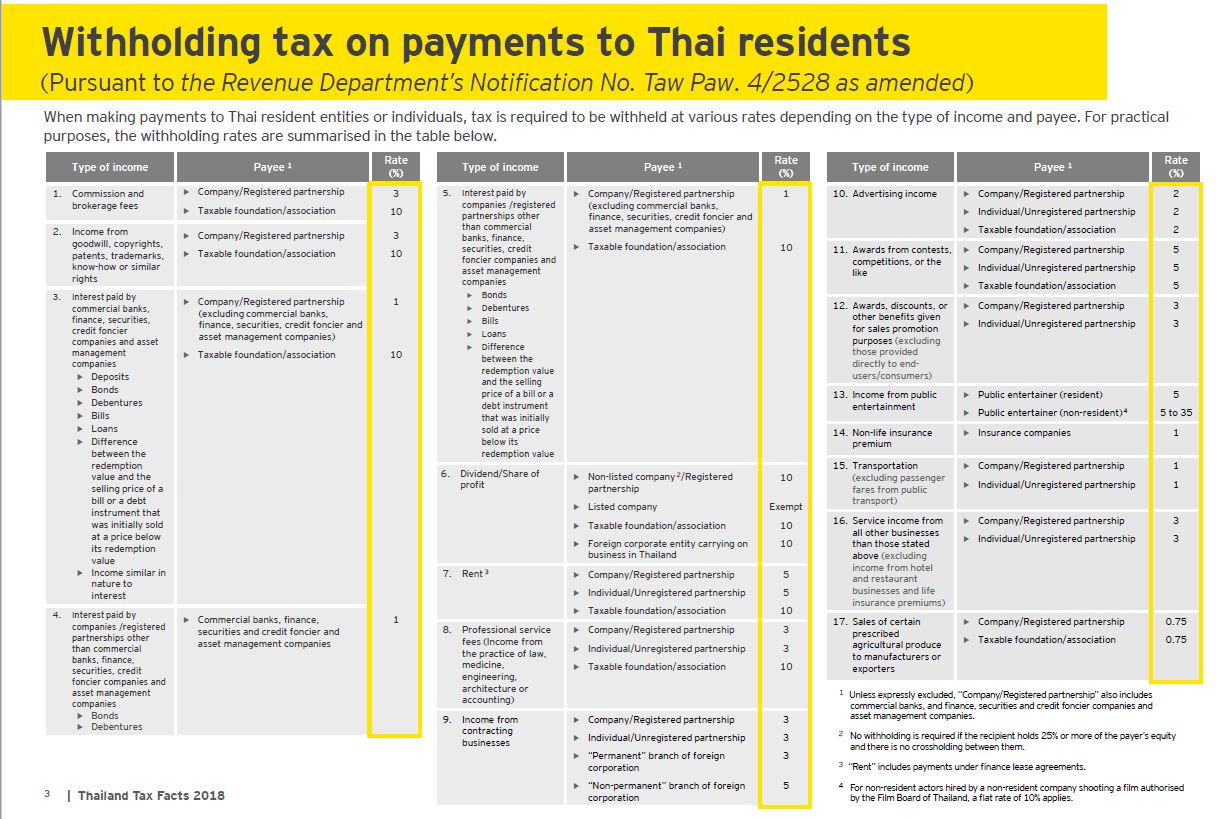

Real Estate Taxation In Thailand Thai Property Group

Income Tax Calculator 2021 Malaysia Personal Tax Relief Malaysia Tax Rate

Special Tax Deduction On Rental Reduction Latest Updated 15 June 2020 Cheng Co Group

Tax Prep Checklist Tracker Printable Tax Prep 2022 Tax Etsy

Rental Income Tax Malaysia And Other Tax Reliefs For Ya 2021

50 Tax Exemption For Rental Income 2018 2020

Income Tax Malaysia A Definitive Guide Funding Societies Malaysia Blog

![]()

Thai Rental Properties And Personal Income Tax Hlb Thailand

Key Tax Impacts From The New Leasing Standard Grant Thornton

Property Rental Income Deductible Expenses

0 Response to "malaysia rental income tax deductible expenses"

Post a Comment